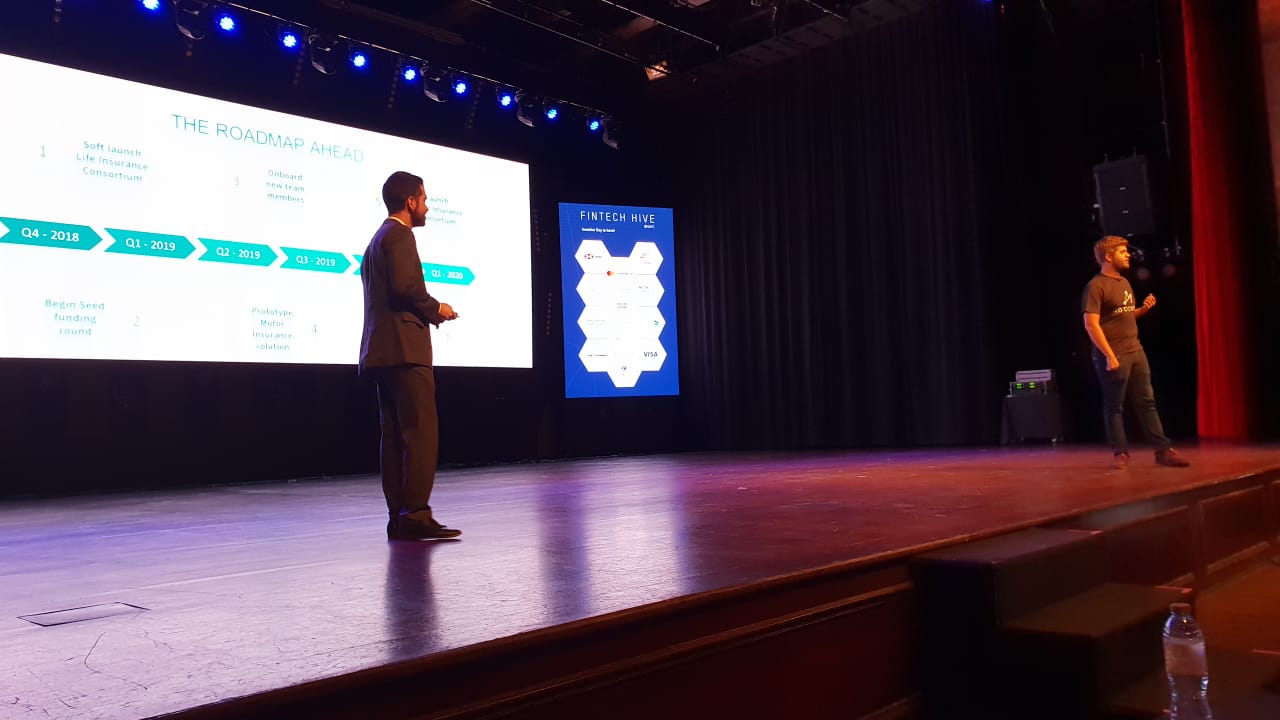

Back in November 2018, I attended the Dubai International Financial Centre, DIFC FinTech Hive 2018 Investor Day.

DIFC FinTech HIVE is one of the biggest accelerator hub in Dubai. It was launched in 2017, in partnership with Accenture. They provide mentorship to innovative startups through collaboration with leading financial institutions and insurance partners. A dedicated space to work, and a community of like-minded individuals is a value-add for the aspiring entrepreneurs and startups.

I was part of the core team of one of the participants at the HIVE 2018; iWealth Technologies, who were presenting alongside the cohort. Being iWealth’s Chief Technology Advisor (CTA), I’m orchestrating their technology platform’s strategy to be the global leader in FinTech platform. The scaling of the I.T infrastructure will be the true differentiator.

The event

The DIFC FinTech Hive 2018 Investor Day was an eye opener for me. I was quite surprised to learn about the 22 start-ups that HIVE accelerated over the year. Most were really very ingenious initiatives. Even the location of the event was breathtaking; the Jumeirah Zabeel Saray Hotel, Palm Jumeirah, Dubai.

The event kicked off with welcome address by Raja Al Mazrouei, and then a very well delivered opening address by Arif Amiri; CEO of DIFC Authority. He vehemently said, “DIFC tripled its commitment to FinTech in 2018, and we have delivered on this promise by broadening our scope, bringing new partners on board and introducing dedicated streams for InsurTech, RegTech and Islamic FinTech. We have also secured support from regional and global investors who are looking to capitalise on the next big solution that will transform the financial services sector, with participants in last year’s cohort already having raised over US$ 16 million in capital. The innovative and diverse pool of start-ups taking part in FinTech Hive this year is illustrative of the growth and success we are seeing in the sector as industry leaders realise the potential of this technology.”

Later, the presentations of the startups and their products was conducted in two separate batches.

Startups that caught my eye

Bondsmart

Being somewhat of an investor myself, Bondsmart caught my complete attention. Their mobile app platform is aimed for the simple investors like myself, who wish to buy bonds safely, quickly, and reliably. Bondsmart value proposition is that they’re one of the world’s first co-ownership bond platforms, with ground-breaking technology for investors and advisers. Alongside, you get potential income from big brands and governments from around the world.

Addenda

Addenda is a UAE-based startup that provies end-to-end insurance settlement through blockchain technology. They are allowing insurers to automate claims, cut their overheads and do fraud identification. Pretty fascinating stuff.

Jibrel

This Swiss techie group is a smart contract development company utilizing the blockchain technology. Their platform is quite innovative, and founded on cryptography, distributed ledger and smart contract technology. They aim to build the financial networks of the future.

iWealth (but ofcourse)

iWealth is a Dubai based educational FinTech platform that is reinventing financial intelligence for teens and parents by teaching them healthy money habits.

Putting a dent in the world

Besides the above 4 startups, almost each had innovative technology solutions that were quite inspirational. It was exciting to know that each of them exuded an exhilaration and will to seriously make in impact in the financial realm, through their solutions.

Equally important were the speeches that were delivered besides the presentations and demos. I particularly enjoyed the following ones:

- “Building up the Guangdong-Hong Kong-Macau Greater Bay Area as a World-class International Innovation & Technology Ecosystem” by Dr. Lee George Lam

- “InsurTech 101” by Mohammad Al Hawari

- “Learnings from a Builder – Ventures, Communities & Bridges” by Varun Mittal

The networking part of the event was well arranged, and very productive for entrepreneurs like myself. The event had a very motivational influence on me, especially knowing the scope of blockchain based solutions. Moreso, the InsureTech industry and its potential was an eye-opener. In my view, it is going to explode, through proper utilization of blockchain and smart solution delivery.

All that is yet to be seen, and I hope the startups of the DIFC FinTech HIVE 2018 deliver on their promises.

I sure would love to hear your comments on this post. A healthy conversation is always fruitful for individual growth.

If you’re an aspiring entrepreneur, then do check out my related post “Famous Five resources for Entrepreneurs”.